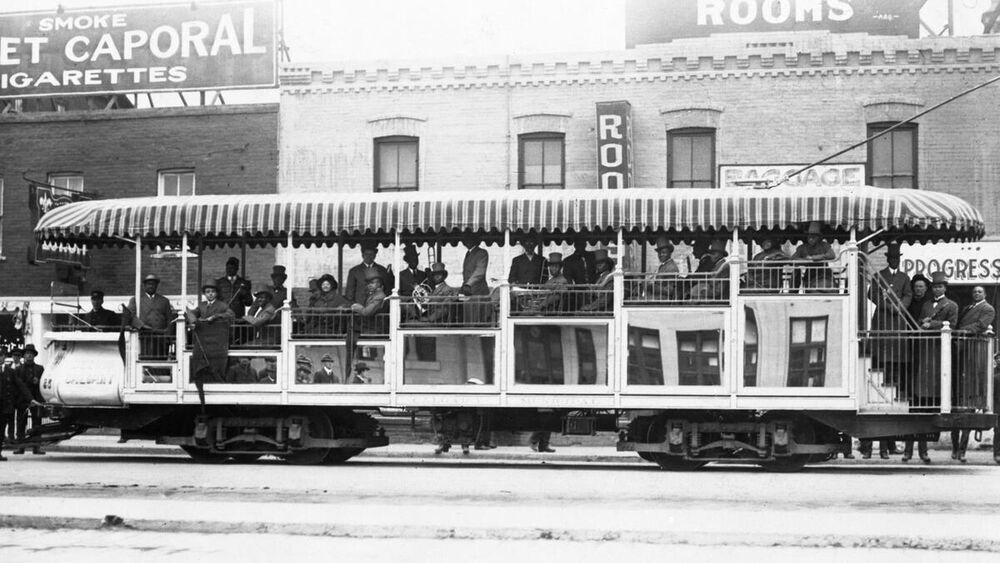

At co-ops like Sunnyhill in Calgary, residents buy shares, not units. Photo: Dave Robinson

Why don’t we have more co-op housing?

The benefits go beyond affordability.

Support independent Calgary journalism!

Sign Me Up!The Sprawl connects Calgarians with their city through in-depth, curiosity-driven journalism. But we can't do it alone. If you value our work, support The Sprawl so we can keep digging into municipal issues in Calgary!

What do you think about when you think about affordable housing?

In broad terms, affordable housing refers to housing that costs up to 30% of a household’s income. It isn’t a fixed amount but rather a cost that changes based on an individual’s or a family’s earnings.

No matter how high your income is, or if you rent or own, if you’re spending more than a third of your earnings on rent or mortgage payments, your housing isn’t affordable—at least not for you.

For a Calgary family making around $102,570 a year, the city’s median income, having monthly housing costs around the city’s average of $1,500 may not be a big deal.

But this is not the case for nearly a quarter of Calgarians.

In Calgary, one in four households have yearly earnings between $60,000 and $100,000 and spend over 30% of their income in shelter costs. These households are below the city’s median income but above the qualification threshold for subsidized or social housing. For them, finding a place to live that suits both their needs and their budget can be a challenge.

Where these families live and how much they pay is dictated by the market.

“There’s a big missing segment in the [affordable housing] market,” said Byron Miller, professor of urban studies at the University of Calgary. “We have a de-facto affordable housing strategy, which is basically urban sprawl.”

We have a de-facto affordable housing strategy, which is basically urban sprawl.

Living on the outskirts of the city also means longer commutes and higher transportation costs—a decidedly unsustainable trend for Calgarians all around.

But what alternative do moderate-income families have? A movement that peaked in the 1970s might be one solution: co-operative housing.

In a city where neighbourhoods are increasingly segregated by income, why aren’t we looking at affordable housing alternatives that have proven successful in the past?

The ‘third sector’ of housing

Co-operative housing is often referred to as the “third sector” of housing, as tenure is neither public nor private.

In a continuing housing co-op, residents become members of the organization when they buy a share upon moving in, which entitles them to their unit—they don’t actually purchase the unit. (In Calgary a co-op housing share costs, on average, $1,500.)

This democratically managed model allows affordable units to remain in the housing stock.

“It’s quite a complex but very interesting housing model,” said Brenda Davies, executive director of the Southern Alberta Co-op Housing Association (SACHA).

“There’s a homeownership component to it—you’re a stakeholder in the community. The share that you purchase entitles you to be able to participate in the democratic process.”

Unlike private ownership, “people own this housing cooperatively,” said Miller. “It’s not like a condo where you own an individual unit, but rather you own a share in the building.”

Co-operative housing is often referred to as the “third sector” of housing, as tenure is neither public nor private.

So instead of rent, co-op members pay a monthly housing charge determined by the members themselves. “We pay that rent to ourselves, effectively,” said Richard Harrison, co-op resident and board chair of Sunnyhill Housing Co-op, a complex just off Memorial Drive in northwest Calgary.

“When I’m talking to my neighbour, I’m talking to my tenant. When I’m talking to my neighbour, I’m talking to my landlord,” Harrison explained.

Housing co-operatives are not new. This model started in Europe in the late 1800s and became widespread in Canada in the 1970s, when the federal government and some provinces provided the support necessary to develop, build and operate this type of affordable housing.

But despite the success of the model (over 80,000 co-op homes were built across Canada between 1973 and 1995), federal funding for new housing co-ops was cut in the 1990s. In the face of austerity measures, the federal government downloaded the responsibility of affordable housing to the provinces, and the provinces transferred it to municipalities—but without funding.

“That’s why we have such a crisis of affordable housing today,” Miller said.

Maintaining an affordable model

With monthly housing charges ranging from a minimum of $500 for a three-bedroom duplex at Sikome Rise to a maximum of $1,387 at Whippletree West in a similar unit, more than 1,000 Calgary families live in 14 continuing housing co-operatives across the city—most of which were developed in the 1970s.

Despite the success of the model, federal funding for new housing co-ops was cut in the 1990s.

There are several reasons why housing co-ops have remained affordable. Besides being kept off the market, affordability in housing co-ops is supported by some government funding, internal subsidies and efficient asset management programs.

Part of the support provided by the federal government in the ’70s was an operating agreement that helped co-ops subsidize some of the units for the length of their mortgages. “Because we had the long-term financing,” said Robert Bott, a long-time resident of Sunnyhill, “our mortgage cost was relatively low.”

But as these mortgages are being paid off 35 years later, many co-ops have stopped receiving federal assistance. To remain affordable, some co-ops have set up internal subsidies. This is the case at Sunnyhill.

Although housing charges don’t surpass 30% of a household’s income, higher-income households pay a surcharge that is used to support lower-income members and keep their housing charges affordable. This is made possible by the economic diversity of the community.

“Mixed communities are the healthiest communities,” said Harrison. “What the co-op does is it puts a mixed community deliberately right here.”

When I’m talking to my neighbour, I’m talking to my tenant. When I’m talking to my neighbour, I’m talking to my landlord.

Another factor that keeps costs low is that the monies accrued over time from the members’ shares can be used to pay for operational and management expenses.

Additionally, co-op units are usually well maintained, which reduces upkeep costs. “What makes them viable over the long haul is that as long as the co-op is well managed and all the maintenance is taken care of, you keep the housing charge down,” Davies said.

Members of housing co-ops have no equity in the assets—and cannot sell their unit. “I’ll walk out of that without any increase because I’m not investing in it,” said Harrison. “What I’m investing is my time and my energy and there is no way that there’s accumulated interest in that.”

By keeping units off the market, housing co-ops ensure that the affordable housing stock remains within the community. “As the years go on, we can continue to house people, and that’s the truly great benefit of housing co-operatives,” Davies said.

The social aspect of housing

But the appeal of housing co-ops isn’t just the cost—they offer more than affordable housing.

Here, families can live within their means and have something most renters don’t: a sense of ownership.

“[Co-op housing] gives you pride in your home, pride of membership,” Davies said. “You’ve got the independence of homeownership but you have more rights than a renter.”

Co-op housing gives you pride in your home, pride of membership.

Living in this state of democratic ownership also brings about a different mindset in people.

“There is that whole sense of, ‘Let’s pool our resources,’” Harrison said. “Let’s share what we have, and all of us prosper.”

Because life in a co-op isn’t just about having a roof over your head, members are encouraged to participate in different ways.

“We have quite a few committees,” Bott said. “We have a member involvement committee that makes sure that people are participating; we have an education committee that tries to educate people about co-ops, and recycling and green living.”

Community participation goes beyond running the co-op. It builds strong ties with neighbours too.

“We have feasts out here,” Harrison described. “People bring the food and we all cook together—we have social events, Easter, Christmas dinner together.” And when social distancing became necessary during the pandemic, “mailbox dinners” became common at Sunnyhill.

“But you have to choose this,” Harrison said. “You have to want to live in a way where you come here to participate in the development and growth of the community. We believe in making a place where people who live there, want to live there.”

And people do want to live there.

There is that whole sense of, ‘Let’s pool our resources. Let’s share what we have, and all of us prosper.’

In Sunnyhill, residents usually stay around 10 years, but there are some who have lived there for up to 30 years. “There are residents who were raised here,” Harrison noted.

Furthermore, the right to stay in a housing co-op without needing to stay below a certain income threshold is an advantage that results in diverse communities in terms of income, background and age groups—people are able to live where they want, as opposed to where they can afford.

But continuing housing co-ops in Calgary have long waitlists. “In the southern part of the province, co-ops are pretty much full all the time,” Davies said. “Waits can be horrendously long. The least amount of time would be two years for some co-ops. But the wait can be as long as eight years.”

Despite this demand, new co-ops haven’t been built in Alberta since the late ’90s. “Trying to develop co-ops at this point is a little bit more difficult than it was back in the day when the government would hand out money,” Davies said.

Left at the mercy of the market

Even though some have argued that co-op housing can cost 71% less than public housing, cities have been slow to support this type of housing. “I don’t know if they [municipalities] really get the mixed-income model,” Davies said.

Waits can be horrendously long. The least amount of time would be two years for some co-ops.

The limited capacity of cities to provide affordable housing has led to efforts focused on those in dire need. “Because we provide so little of it [affordable housing] we target those who are most in need—which is appropriate given how little of it we have to distribute,” Miller said.

“But if we had more, we could make it available to many more people.”

A more robust supply of affordable housing could support the moderate-income Calgarians who are currently left at the mercy of the market—and who might end up living in unaffordable, unsuitable and inadequate housing.

“[Co-op housing] is a way of providing affordable housing on an ongoing basis,” Miller said. “It provides affordable housing for the lower middle-income households that aren’t poor enough to qualify for subsidies.”

Ximena González is assistant editor of The Sprawl.

We want to hear from you! Send letters to the editor to hello@sprawlcalgary.com.

Support independent Calgary journalism!

Sign Me Up!The Sprawl connects Calgarians with their city through in-depth, curiosity-driven journalism. But we can't do it alone. If you value our work, support The Sprawl so we can keep digging into municipal issues in Calgary!