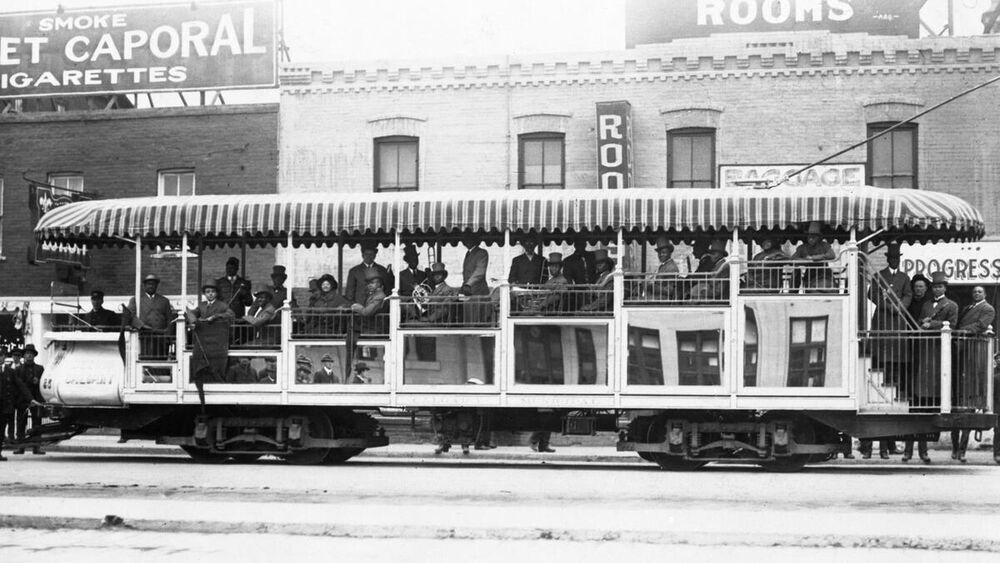

Sofia Khalil is calling for action from the province after her home was damaged in the June hailstorm. Photo: Patrick Earl Concepcion

Canada’s worst hailstorm leaves Calgarians in limbo

The UCP response hasn’t matched the disaster’s scale.

Sofia Khalil has been feeling defeated lately.

She’s a prudent woman, more so since the pandemic hit. Khalil is a senior citizen and stage-four cancer survivor. She doesn’t leave her Taradale home unless she needs to. But on June 13 she spent the day in Banff with her daughter, drenched in sunshine and absorbing the much-needed crisp air. Her spirits began to lift.

On the balmy drive home, Khalil received a panicked call from her son. To say “what came next was unexpected” would be an understatement.

“Don’t come home,” he pleaded. “Take cover.”

When she and her daughter drew closer to Khalil’s residence, all sense of familiarity dissipated. Sinister clouds crept into view, dampening the sunshine the two enjoyed moments earlier.

The storm started innocently enough—dense rain and small pellets shot down from above. Then something shifted. Icy golf balls battered Calgary’s northeast communities. Cars were peppered with dimples, windows exploded, homes were unrecognizable.

“I said, 'Oh God, what's happening?'” Khalil recalled.

The Alberta government’s lethargic response has not matched the scale of the disaster.

Northeast Calgary bore the brunt of the worst hailstorm in Canadian history, and Canada’s fourth most-costly natural disaster (an estimated $1.2 billion in insured damages). But the Alberta government’s lethargic response has not matched the scale of the disaster.

When economic turmoil and the pandemic made jobs uncertain, some were forced to cut insurance from their monthly spending. Those who had insurance waited weeks for help after the storm—and some are still waiting.

The uninsured were left to fend for themselves. The rest battled through a web of deliberate jargon, overwhelmed phone lines and apathetic insurance providers. Now residents and community leaders say they’ve had enough.

The province dawdles to aid neighbours

As the hailstorm rolled through northeast Calgary and parts of southern Alberta on June 13, social media was full of images of the destruction. Words of support and disbelief trickled in.

Later that evening, the premier joined the discourse.

“Thinking of all those hit by the storms this evening in Calgary and parts of southern Alberta. Despite the damage to property, hoping that everyone is safe and unharmed,” Alberta Premier Jason Kenney wrote on Twitter.

Thinking of all those hit by the storms this evening in Calgary and parts of southern Alberta.

— Jason Kenney (@jkenney) June 14, 2020

Despite the damage to property, hoping that everyone is safe and unharmed. https://t.co/UEZ1BCdLXB

The tweet was not well received by all.

“We need you to do more than just think of us and take action,” one user replied. “I can pay my deductible but what about all the hurting people that can't make a $250 or $500 or a $1,000 claim cost.”

On June 25—almost two weeks after the disaster—Kenney announced provincial support for impacted areas. The hailstorm was deemed an “extraordinary event,” which meant the provincial government would provide access to funding through Alberta’s Disaster Recovery Program (DRP).

But that money is wrapped up in a ribbon of red tape. The DRP covers events that are uninsured and indicates that its seekers must explore their “own insurance options first.” It also does not “cover all types of damage or loss and does not typically cover the full cost of replacement,” as stipulated on the DRP page.

“It's been pretty inadequate, both what was said, but also what was done,” said Jason Klinck, a program coordinator for Action Dignity—a community organization which addresses racial inequity, human rights and public participation.

Sometimes I cannot sleep because I think, ‘What will happen? Winter is approaching.’

Mirroring the DRP, Kenney said in his announcement that private insurance will likely cover most of the damage. Which is true, in some cases.

“There were a lot of people that were either uninsured or underinsured. Or they were insured, but they couldn't afford to pay the deductibles,” Klinck said.

Margaret (not her real name), who asked to remain anonymous for fear of retaliation from her insurance provider, is one of the residents struggling to keep up with deductibles.

“I live on a pension and with the pension, I'm not even able to make my ends meet,” she said. “To come up with a big amount of cash, to be able to pay for the deductibles... did not sit well with me.”

Klinck and other community leaders took matters into their own hands.

Khalil Karbani, a community organizer and co-founder of the Genesis Centre, led a group of northeast residents in an awareness campaign. They called and wrote to MLAs, reached out to local media and called on the premier’s office for real support.

But all routes the group took twisted into a maze of frustration, Karbani says.

The MLAs directed citizens to contact the premier. The premier’s office forwarded concerns to the Insurance Bureau of Canada (IBC). The IBC said to contact private insurance providers. And insurance providers told people to contact their MLAs, thus completing the maddening circle.

“It depends on the actual circumstance,” said Rob de Pruis, the director of consumer and industry relations for Western Canada at IBC. He says that the role of the IBC is to provide information about insurance policies.

“If they [insured consumers] have a specific question about their policy or about their specific claim, we don't have access to their specific insurance information. So we would typically direct them over to their insurance company."

But ultimately, the bureau’s job is to provide consumers with general guidance about insurance, de Pruis says.

The worry is right now that your house is not going to get repaired on time.

“The government [is] not looking at the bigger picture right now,” Karbani said. “And the bigger picture is that how do we get these people back on their feet?”

“[I ask] the people who voted for this government: Doesn't it have any responsibility?" Sofia Khalil said. "I don't see anything happening.”

Designating the hailstorm as a natural disaster would allow access to funding through the federal government. But it’s on the provincial government to apply for the classification—and that hasn’t happened yet.

The Sprawl reached out for comment to Timothy Gerwing, press secretary for the Ministry of Municipal Affairs, but did not receive a reply by deadline.

Tangled in the fine print

When Khalil first saw her home, she jolted in fear. At first glance, she didn’t realize the extent of the damage. Her windows were shattered, her siding was chipped and her roof was tattered.

“The insurance people, they came after three weeks,” she said. “They came, they just looked around and then they're gone and no reply, no response. Sometimes I cannot sleep because I think, ‘What will happen? Winter is approaching.’”

Saymah Chaudhry faces a similar situation.

“Even for people who have proper coverage, the worry is right now that your house is not going to get repaired on time,” Chaudhry said.

Her insurance provider says that they’re overwhelmed, which is why it’s taken them weeks to repair her family’s roof. There have been a number of lesser storms since the disastrous hailstorm on June 13. Without repairs, residents are powerless in the face of mold, leaks and—eventually—bitter cold temperatures.

“It's a lot of money,” Chaudhry said. “Why am I not getting the service that I need and getting it done? I know you're overwhelmed. But then, I think that means you need to hire more people. You might have to go outside of Alberta to get people to come and do some construction here.”

Some insurance companies have been outsourcing to accommodate the demand.

CRU Group, an independent adjusting firm which operates in Canada and the U.S., brought in about 400 out-of-province adjusters. Intact Insurance is using its Rely Network—a group of property restoration contractors—to provide support for those in emergency situations.

The stress of the pandemic compounded with the hailstorm is taking its toll on northeast residents.

“For property claims, we have adjusters working in the impacted communities,” said Jennifer Beaudry, Intact’s media relations manager, in an email to The Sprawl.

“We are also utilizing our service centre and have set up additional hail appraisal centres to see customers with auto claims faster,” she added.

Beyond property damage

The stress of the pandemic compounded with the hailstorm is taking its toll on northeast residents, who say they feel left out to dry.

“People were worried, people had anxiety, people had depression—and then the hailstorm comes,” said Karbani. “That's not even the worst part. It's when the insurance assessors come.”

“Then they tell us that, ‘Oh, here's your insurance policy that we always covered you for the last so many decades, but this time around, we're only going to give you 20% of what your value is worth.”

That’s been Margaret’s battle since this all began.

A lawyer can’t read those 25 to 40 page documents… How are we regular folks supposed to read that?

“I started fighting with my insurance. To my horror, they confirmed that I had to come up with 30% depreciation,” she said. “They had already increased my deductible.”

Her home still hasn’t been fixed. With nowhere else to turn, she looked to her MLA and wrote to the premier’s office. Three weeks later, she still hadn’t received a response—she’s on her own against the policy she pays to protect her.

Margaret says that unless you've experienced something similar, it can be hard to grasp the extent of the problem.

“You don't have funds in your hands,” she said. “You get up in the morning, you go out and you come back and you see damaged homes, and you don't have a job.”

Insurance policies are notorious for their pages upon pages of legalese and fine print. The devil gets lost in the details, and people end up signing a document they don’t completely understand. Or they trust their brokers to sort it out—if residents can afford to have a broker in the first place.

“A lawyer can't read those 25 to 40 page documents that you make us sign,” said Saima Jamal, a community organizer. “How are we regular folks supposed to read that? And language is a barrier. People just give you papers. Nobody reads those insurance documents.”

Northeast residents feel isolated

The northeast is the most diverse quadrant of the city. Its vibrant neighbourhoods are home to various languages and cultures.

On average, approximately 5% of residents of Ward 3, 5 and 10 do not speak English or French (according to the 2016 Census of Canada).

It’s hard to believe that it would have been the same reaction if [the storm] would have hit in the southwest.

Klinck and Action Dignity are researching the impact of systemic racism on the city’s northeast—which faces a fair share of dangerous, negative narratives.

When disaster struck in the past, Calgarians and Albertans banded together. The flooding in High River, the fires in Fort McMurray, Calgary’s 2013 flood—these events are all remembered as tragedies that brought us together in support.

Klinck says that while no one is comparing, the lack of urgency surrounding the hailstorm paints a clear picture.

“There was no outpouring of either government or public sympathy towards what was happening,” Klinck said. “It was just seen as kind of a rainstorm or downplayed a bit.”

“It's hard to believe that it would have been the same reaction if [the storm] would have hit in the southwest.”

We can’t ignore why that might be the case. The quadrant has been (and still is) victim to both silent and obvious discrimination. There is an undeniable stigma attached to northeast communities: the idea that they’re dangerous, they’re poor, they’re “less than.”

Residents are more than aware of that narrative.

We’re doing everything that we can and the government does nothing.

“It's the stigma that goes along with being the visible minority and being racialized,” Chaudhry said. “I think that's why we're out of the way.”

The hailstorm destroyed homes, cars and property. But lacklustre responses from the province, insurance companies and other Calgarians are causing additional damage.

“I felt left out and kind of segregated,” Margaret recounted. “And I just felt that, you know, when you need help the most, that's the time the door is shut.”

Neighbours, all impacted by the storm, have relied on one another for support since they weren’t getting it elsewhere. Jamal says that she and a team of volunteers have raised money for repairs, insurance deductibles and whatever else anyone required.

“We're doing everything we can as community members," Jamal said. "But if we're doing everything that we can and the government does nothing, imagine how it feels.”

“You hope that they will stand beside you because they came to you asking for votes… And now they [the MLAs] are so distant and many of them, they're not even answering calls.”

On July 22, Klinck, Karbani and a group of organizers made their way to the Alberta legislature in Edmonton. They asked for action, accessible support and for no resident to be left behind.

“Northeast Calgary is part of Calgary every bit as much as any other part of this city, or this province,” Klinck said.

Jamal says that now is the time to demonstrate the “togetherness” that Calgarians are famous for. This fight shouldn’t be on a single community or group of activists.

“People are at their breaking points,” said Jamal. “They need help. Show some kindness, push your government and ask for that [help].”

Hadeel Abdel-Nabi is The Sprawl’s staff writer intern.

Now more than ever, we need strong independent journalism in Alberta. That's what The Sprawl is here for! When you become a Sprawl member, it means our writers, cartoonists and photographers can do more of the journalism we need right now. Become a Sprawl member today!

Support independent Calgary journalism!

Sign Me Up!The Sprawl connects Calgarians with their city through in-depth, curiosity-driven journalism. But we can't do it alone. If you value our work, support The Sprawl so we can keep digging into municipal issues in Calgary!