Photo: Rob Moses

The limits of density: If you build it, who will come?

Supply alone won’t make Calgary less segregated.

In 2018, Luis Virla and his young family were priced out of the two-bedroom-plus-den apartment they had been renting for three years at The Arch, a purpose-built rental located just west of the Beltline.

They had plenty of space in the unit and enjoyed the walkability and amenities of the neighbourhood, but when their rent was set to increase by almost $300, renewing their lease for another year was out of the question.

“We looked for something budget-friendly in a central location with easy access to transit,” Virla said.

But the closest they could find to the city centre and its amenities within their price range was a two-bedroom unit in Windsor Park, an established community just north of Chinook Centre. Their rent is still higher than Calgary’s median monthly rent of $1,289 for a unit that size, but affordable for the Virlas.

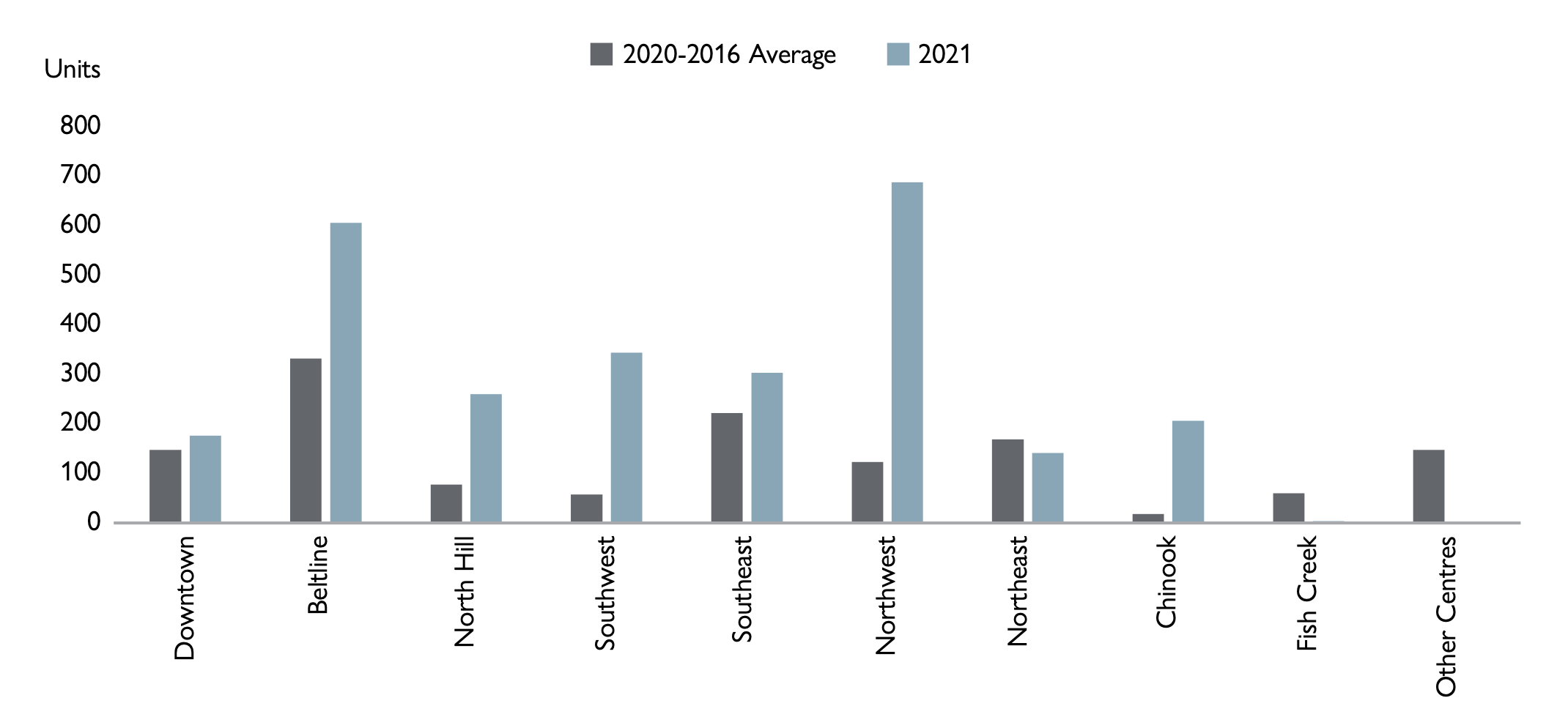

The recent increase of new purpose-built rentals coming online in our city’s centre should be welcome news for Calgarians who, like the Virlas, wish to live a more sustainable lifestyle in an amenity-rich, walkable neighbourhood. An increased supply of housing should—at least in theory—keep rents within an affordable range.

Yet, newly-released data from CMHC shows that despite a 9% increase in Calgary’s rental stock in 2021, rents increased significantly for two- and three-bedroom units located in desirable central neighbourhoods such as the Beltline, Bridgeland, Crescent Heights and Sunnyside.

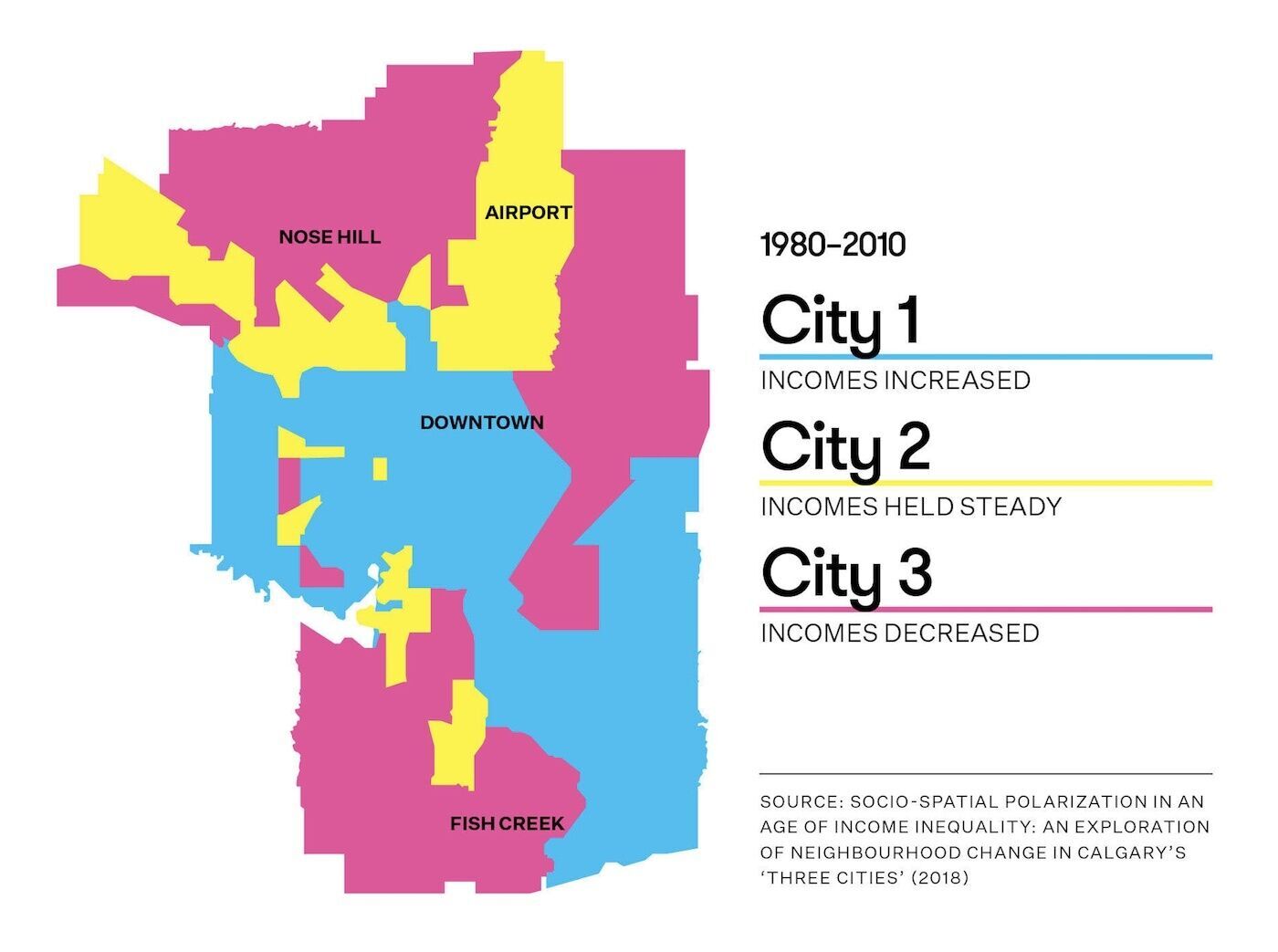

According to a 2018 report co-authored by Byron Miller, a professor of urban studies at the University of Calgary, Calgary neighbourhoods are increasingly segregated by income, creating three distinct “cities.” Between 1980 and 2010, low- and middle-income Calgarians left the inner city for suburban communities. Affluent Calgarians, meanwhile, moved into the inner city.

Four years after the report came out, Miller says density alone will not solve the troubling patterns identified in this research.

“The market sorts people out in space,” Miller said. “Increasingly, the more desirable places are viewed as being in the inner city, so higher income people will outbid lower income people… and the people who have less money will be left with whatever is left over in the least desirable locations, which tends to be the more remote locations where people have to spend more time commuting.”

Who benefits from upzoning?

Across North America, affordability advocates and YIMBYs (Yes In My Backyard) frequently call for the removal of red tape—specifically, zoning regulations—that seem to constrain the capacity of developers to build as much housing as our growing cities require to remain affordable.

“The best way to create access to [desirable neighbourhoods] is to increase the supply,” said Alkarim Devani, president of inner-city Calgary builder RNDSQR. “And to make sure that single-family zoning is not what stops people from getting entry into these marketplaces.”

Within the current policy framework, says Devani, “it’s very difficult to meet policy and still push affordability.” Compared to suburban development, he explains, there are multiple hoops that get in the way of developers delivering affordability in the inner city: from community engagement to heritage preservation to parking requirements and traffic concerns.

And these challenges translate into increased land values for the parcels that do get upzoned in established neighbourhoods.

“We’ve created a system that’s fundamentally flawed,” he said.

In a free market, the less affluent are frequently displaced to give way to more profitable developments that bring cash to both developers and the city’s coffers, in the form of property tax revenue.

We’ve created a system that’s fundamentally flawed.

“When we talk about higher-income people coming into the inner city and displacing lower-income people, we also have to think about capital from around the world coming into the city, and seeking to get a higher rate of return on their investment in what had previously been lower-income neighbourhoods,” said Miller.

“There is an economic motivation to generate more income, to create more economic exchange value on a parcel of land.”

Case studies have shown that allowing for more density (a.k.a. upzoning) doesn’t necessarily result in developers flooding the market with new housing. Due to the nature of their business, developers build when and where the market is right.

“Ninety-nine percent of developers want to charge the highest rates,” Devani said. “The whole idea of [real estate development] is about returning capital for your shareholders. You can’t be a business if you’re not making a profit.”

While in the past renters have tended to be less affluent than homeowners, in recent years Calgary has observed an increase in the share of higher-income renters.

“Today there is a disproportionate amount of demand for folks who want to live in the inner city,” said Devani. “Young professionals are now renting family-orientated three-bedroom housing within established neighbourhoods.”

But what happens when the lifestyle of young, hip and affluent professionals overlaps with that of cash-strapped Calgarians?

'It was difficult to find a similar place'

Here’s how one scenario recently played out in Sunnyside. A parcel that contained four single-family homes was rezoned in 2017 to allow for an eight-storey building.

Yet the owner won’t be submitting a development permit until this summer—five years after the rezoning application was approved.

Despite this delay, in early in 2020 Karen Mills and William Gillies were evicted from one of these four houses as they were about to be demolished. After leaving the 1912 house they’d rented for eight years at an affordable rate, the young couple moved a few blocks east, in the same community, to a two-bedroom unit in a walk-up apartment built in the 1970s.

“It was difficult to find a similar place, and we didn’t have reliable transportation that wasn’t Calgary Transit,” Mills said. “So we couldn’t really find another house that would be within the train line or a good bus route.”

Now living in a higher-density building in an area zoned for transit-oriented development, they believe this new place will be more stable. “If we lived in another little bungalow again, I suspect that would always be the issue—that it would get redeveloped,” Gillies said. “I don't think this is going to happen to this building.”

But just two blocks west from their previous home, two walk-up apartment buildings were demolished in 2019 to give way to 79 luxury rental units whose monthly rent ranges from $1,675 to $2,550.

This amount is beyond the means of one in three Calgary households—including Mills and Gillies, and the Virlas.

Not all housing trickles down equally

The conventional wisdom has been that an increased supply of market rate housing will eventually trickle down to lower income households through a process known as filtering. That is, as affluent households move to more expensive housing, they will free up affordable units for everyone else—a process that’s supposed to happen even faster when it comes to rental units.

“Basically, the people who need affordable housing will get the leftovers from people who are moving out,” Miller explained.

But the effectiveness of the filtering process is questionable, as it fails to consider cities as an open system where new residents take the filtered units from existing residents, and doesn’t account for the specific location where the cheaper units are located.

Filtering also disregards the loss of affordable units to new (and more expensive) developments.

As new builds in desirable inner-city neighbourhoods replace older, cheaper units, the situation exacerbates the spatial segregation of Calgarians.

We weren’t able to afford to live in the few areas where we don’t have to drive everywhere.

For the Virlas, filtering meant driving 15 minutes south from downtown to a fourplex built in the early ‘90s. Despite this seemingly short distance from the city centre, they’re also giving up nearby amenities, walkability and easy transit access.

“We weren’t able to afford to live in the few areas where we don’t have to drive everywhere,” says Virla.

In the midst of a climate emergency, pushing lower- and middle-income Calgarians into car-dependent communities has crucial consequences.

“There’s this very abstract notion that a more dense city is a more sustainable city,” Miller said. “But there are limits to that argument.”

“One of the things a sustainable city must have is the ability for people to move around relatively easily, to have their needs met relatively easily.”

Miller says the concentration of lower income people in the outskirts of the city who have to commute to higher-income areas for work is “locking in” emissions patterns.

As long as lower- and middle-income people have no option but lengthy commutes by car, energy consumption won’t be curbed, he says.

“You cannot separate questions of socio-spatial equity and questions of sustainability.”

Supply alone doesn’t solve the problem of neighbourhoods becoming more homogenous, either.

“You cannot ensure social mix with density policies,” said Miller.

There’s this very abstract notion that a more dense city is a more sustainable city. But there are limits to that argument.

Alternatives that could ensure affordability

Because it’s widely accepted that filtering won’t reach very low income earners, the city focuses most of its limited social housing efforts on creating affordable housing for Calgarians whose household income is less than $44,000.

Devani says increasing the capacity of developers to access financing for mixed-income developments is key to prevent the displacement of lower income Calgarians, but the lack of alignment among affordable housing policies at different levels of government make it nearly impossible.

Furthermore, he adds, the limited choice available to less affluent Calgarians also makes them more vulnerable to predatory landlords and REITs (real estate investment trusts) whose primary goal is to turn a profit for their shareholders.

“The issue with these older apartments that are being torn down [is that] they’re not well maintained housing,” Devani noted. “Some of them really shouldn’t even be housing people.”

Indeed, the financialization of housing takes a greater toll on those at the bottom rung of the income ladder. In Calgary, investment trusts such as Boardwalk, Mainstreet and Avenue Living own a large share of the affordable rental market.

Ultimately, to ensure a sufficient supply of affordable housing equitably distributed across the city, an assortment of policies and mechanisms is needed, Miller says.

Non-market alternatives such as inclusionary zoning—which requires a percentage of units in a new build to be affordable—or community land trusts can help fill the gaps left by the market-driven supply and support the availability of choices for all of our city’s renters.

“You have to have forms of social housing and cooperative housing if you’re going to ensure that you have an adequate supply of affordable housing,” Miller said.

“As long as you pretend that the market will do this, I think [affordability] is not going to happen.”

Ximena González is a freelance writer and editor. Her work has appeared in The Globe and Mail, The Tyee and Jacobin.

CLARIFICATION: This story has been updated to clarify the city's income threshold for who is considered eligible for affordable housing.

Support thoughtful, community-driven journalism.

Sign Me Up!The Sprawl connects Calgarians with their city through in-depth, curiosity-driven journalism. But we can't do it alone. If you value our work, support The Sprawl so we can keep digging into municipal issues in Calgary!